When a newspaper reporter asked bank robber Willie Sutton why he robbed banks he answered, “Because that’s where the money is.” And Willie was right if you’re trying to grow a business too-banks do supply the bulk of the money for small businesses.

In effect, bankers are financial intermediaries. They’re a little like Robin Hood except that banks take from the cash-rich and give lend to the cash-poor. In essence, banks rent money to you at a price (interest) rate that’s high enough to cover the interest they pay on the money they borrow from depositors, plus the bank’s fixed expenses, and some level of profit.

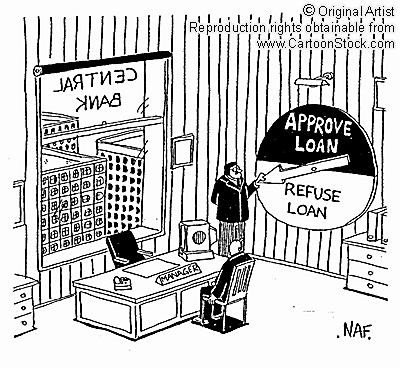

What a bank can offer you is limited by commercial banking regulations designed to protect the deposits (maybe your deposits) that the bank is lending. The bank’s size, its own asset/liability mix, and their management preferences all influence what the bank will do. As a result, banks vary widely in their product offerings and risk appetite, and it’s not at all unusual for the same loan request to be approved at one bank and declined at several others.

Business loans from banks range from a minimum of a few thousand dollars to a maximum based on the size of the bank and their risk appetite. Smaller banks are therefore more limited than larger ones in the amount they can lend an individual borrower. But smaller banks solve this problem by sharing larger loans with other banks, through what are called participations.

While some unsecured commercial loans are extended by banks, most small-business loans are secured with liens on company and personal assets. You may not have to pledge your first born, but lenders will require personal guarantees (joint with spouses) and personal collateral from anyone who owns more than 20% of the company—especially if they feel that the business doesn’t have a strong credit history, reliable cash flow, or offer enough collateral. This is typically the case with young businesses, service businesses, retailers, and fast-growing businesses. The owner’s home is often taken as additional collateral on such loans, so don’t feel like you’re being singled out if they want you to pledge everything you own. Just about every business owner goes through the same thing at some point. Think of it from the bank’s perspective: if you’re not willing to risk everything, why should they?

Expect the loan approval process to take several weeks at a minimum. For loans over $100,000 a four to eight week approval process is not unusual. Once the loan is approved it may take several days or even weeks to actually receive the funds, so don’t spend it before you have it. Complex loans that require nonstandard loan documents will take longer.

Many business start-ups are funded by people who found the money they needed through home equity loans, second mortgages, first mortgage refinancings, and personal loans from banks. These differ from commercial or business loans in that they are often handled by the consumer lending side of the bank rather than the commercial lenders. If your credit is good and you have a strong income history (that looks like it will continue in the future) consumer loans are easier to obtain than commercial loans, they’re governed by consumer protection regulations, and they have fewer strings attached.

Many lenders don’t care if you use a consumer loan for business purposes, but others will send you to straight to their commercial loan division if you indicate the money is for a business. So shop around before you try the old “I just want the money for a vacation and to fix up some stuff around the house” trick—it’s fraud, although that doesn’t seem to stop a lot of people.

Consumer lenders don’t require that you submit a business plan, company financial information, or most of the other documentation that business lenders require. Typically consumer loan applications are less than four pages including a personal financial statement. Approval within days and even hours of application is often possible. And thanks to consumer protection laws, as long as you continue to make your payments, even if your business falls on tough times, you probably won’t run the risk of having the bank require that you immediately pay off the loan…something which can and does happen with business loans. In addition, consumer lenders may or may not require collateral depending on your credit and income history.

We’ve compiled everything we’ve learned from 25+ years as a banker, investor, venture capitalist, and entrepreneur into an all new and up-to-date eBook. Finding Money—Secrets of a Former Banker includes information about small business loans, raising money from angels and other private investors, venture capital, government loans, grants, preparing a business plan or financing application, and other money management advice. Finding Money is available for immediate download. Order your copy today.

3 Responses to Bank Loans For Small Business

wp_list_comments(); ?>