Home Business / Self-Employment / Freelance Disadvantages

While there are lots of benefits to running a small home business, it isn’t without its downsides.

The National Federation of Independent Businesses regularly polls its members about what keeps them up at night.

Small Business Owners’ Top Concerns

Cost of health insurance (56%)

Fuel costs (42%)

Business taxes (25%)

Property taxes (25%)

Workers’ compensation costs (24%)

Tax complexity (23%)

Unreasonable government regulations (21%)

State taxes (21%)

Cash flow (21%)

Locating qualified workers (20%)

Death taxes (20%)

Cost and availability of liability insurance (19%)

Finding and keeping skilled employees (18%)

Poor profits (17%)

Cost of supplies/inventories (17%)

Electricity costs (16%)

Frequent changes in federal tax laws/rules (15%)

High fixed costs (13%)

Social Security taxes (13%)

Controlling my time (13%)

Here are more details and our own additions to some of the things that tend to sour the entrepreneurial experience.

Health Coverage

According to the National Federation for Independent Business survey, health insurance costs were a critical issue for almost two-thirds of respondents.

As an employee, your employer paid some of your health care costs. For some home business wannabes, replacing health care coverage is so difficult and/or costly that it bursts their entrepreneurial bubble altogether. In some states, such as California, pre-existing conditions can preclude you from getting individual coverage at all. Individual or even group health coverage (such as one offered by an association or other membership organization) will likely cost significantly more if you have your own home business than what your employer paid.

In addition to the home business owner’s health care woes, the cost of health care limits their ability to grow and attract good employees.

Taxes

As an employee, your social security taxes and medicare taxes (totaling 12.4% and 2.9% respectively in 2009) are split 50/50 with your employer. The social security portion only applies to the first $106,800 of your net earnings. As a freelancer or home business operator, you are both the employer and the employee so you pay both halves on any salary that you pay yourself. That adds 7.65% to your tax bill-although half of that is tax deductible. Take a look at the IRS web site for more details.

But the tax burden doesn’t stop on page two of your federal tax return. State and local taxing authorities may impose additional taxes on your small business.

Sadly, the tax system is so complex that it’s practically impossible for small and home business owners to prepare their own tax returns—that adds another $500 to $2,000 to your cost of compliance.

Sales Tax

If you are selling anything that is subject to sales tax in your home business (most services are not in most states), you’ll need to be familiar with the sales tax laws in each state where your customers reside. If a t-shirt designer, for example, both designs the shirts and has them printed for his client—something he or she may do in order to make additional money on the shirts themselves—the shirt portion of the sale may be subject to sales tax unless they have a reseller’s license and document the sale properly.

For now, internet sales are exempt from sales tax, but stay tuned as that may change.

Extra Paperwork

Uncle Sam and most states don’t like to wait for tax income from business owners, including those with a home business. As a result, you’ll need to file and pay quarterly estimated taxes.

Sales tax returns are generally filed quarterly but some businesses are required to file monthly.

If your home business uses subcontractors you may be required to file 1099′s for them at year end.

If your home business has employees, that opens up a whole other can of worms with payroll taxes, workers compensation, and a whole host of other regulations and issues.

Workers’ Compensation

As the owner of a home business, you can exempt yourself from workers’ compensation, but if you have employees it’s another story. Here in California, workers’ compensation rates are a weird nightmare.The nightmare part is the high rate. The weird part is how they’re determined. In our flying business, the rate for pilots was 12 percent—so we paid 12 cents to the California Division of Workers’ Compensation over and above every dollar of pilot salary. The rate for ground crew, the kids who swept floors and helped people into the airplanes, was 18 percent, 50 percent higher. Go figure. And if that wasn’t bad enough, if one of our office staff ever helped in the hangar, the workers’ compensation rate would jump from3 to 18 percent for that job, regardless of who held the position or how often they did it.

Other Home Business / Self-Employed Insurance

Check your homeowner’s policy to see if the office equipment you use in your home business is covered.

If you’re using your personal vehicle in your home business make sure commercial use is covered. A business sign on the side of the car, for example, could affect your coverage in the event of an accident.

If anyone (customers/subcontractors) is visiting your home office, you may need to add liability insurance.

Disability and Income Replacement insurance can protect you if you are unable to work when you are self employed, but it is expensive, hard to come by, and full of caveats. In most cases, the insurance only covers you to the extent of your prior reported net income.

No Sick Days, Paid Holidays, or Paid Vacation

Can you imagine taking a job that offered no time off, no sick days, no paid holidays,no vacation? The average employee receives a month of pay each year for time they don’t work. As a home business owner, you’ll find the boss far less generous.

No Benefits

Your new employer (you) won’t offer a 401(k), retirement plan, or gym membership, either.

The Buck Stops Here

We all make mistakes. Some are bigger than others. As an employee, regardless of how big the mistake you make, someone else pays to clean it up. As a home business owner, your screwups are your problem. We once spent $5,000 on an ad that produced zero calls, never mind any sales. Ouch.

No Safety Net

For most home business owners, there’s no unemployment insurance, workers’ compensation, disability insurance, or other safety net to break the fall.

Lawsuits Lurk at Every Corner

We probably don’t have to pontificate on how lawsuit-happy the world has become, but for a business owner, lawsuits are a sad reality - even for a home business. In our flying business, we required our passengers to sign a four-page ‘‘we didn’t mean it, you can’t sue us’’ release of liability. Still, we feared the day when someone would trip over their own feet and sue us for their clumsiness. It never happened, and we never had to fall back on the waiver, but it’s sad to have to run your home business based on thinking that runs from the courtroom back.

Liability insurance to protect your home business, if you can find it, is expensive. While it isn’t noted in the list of concerns in the table above 1 in 10 business owners consider the cost and availability of liability insurance a critical problem.

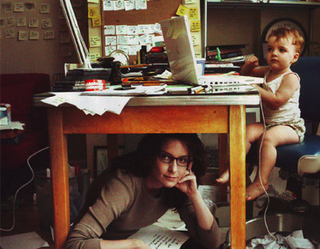

So Much to Do, So Little Time

Home and small business owners stretch themselves pretty thin. There’s always more to do. The only way to clear your to-do list is to close the business, sell it, or die. For some people, being constantly busy is a good thing. For others, especially those who tend to get lost in the minutiae, it can be a real problem.

The Home Business Stigma

Though attitudes are changing, there are still people who will dismiss your home business as a hobby because you choose to forego the commute, save gas, reduce pollution, keep your overhead low and spend more time with your family and friends.

Regulation / Zoning Issues

Even with the best of intentions, it’s easy to run afoul of some federal, state, county, city, or even homeowner association regulation when you operate a home business.

Here’s one we encountered. A pilot can earn a license at age 16 (14 in a glider or sailplane). But according to the job police they can’t earn money to pay for lessons, by rubbing grease off planes or sweeping the hangar floor, until they’re 18. In spite of our honest efforts to comply with every rule the government threw at us, this was one of those little nuances we weren’t aware of until we’d been in business for 12 years.

In another situation, we bought a lovely old 1949 Studebaker pickup, in tip-top shape, to advertise the business. The first night we parked it outside our condo, the homeowners association informed us that we couldn’t keep it there. Apparently, vehicles with signage were considered a neighborhood eyesore. Oddly, they didn’t seem to have a problem with the realtor’s Cadillac with company information on their car door panels.

Before you embark on a home business, be sure to do a thorough search of the rules and regulations that might affect you. Find a small business association that puts out alerts to changes, or use a Google Alert to clue you in to any changes that might impact your business. Violations, even unintentional ones, can be costly. Home-based businesses should be particularly careful of local or homeowner association rules that may limit their activities.

Effect on Personal Credit

If you’ve never been self-employed, you probably haven’t noticed the little box on all credit applications that says, ‘‘Check here if self-employed.’’ It might as well say, ‘‘Check here and you can be sure it will be harder for you to get a loan.’’ Here’s why it’s harder for small and home business owners to obtain personal credit: (a) business use of personal credit cards affects your credit score; (b) personal guarantees on business loans (which are universally required for small businesses) may appear as contingent liabilities on your credit report; and (c) consumer lenders are used to dealing with 1099 and W-2 income. Since a small business owner’s primary income comes from the net profit of their business (which is not reported on a 1099 or W-2), their tax returns look different from those of a typical consumer. The fact that home business owners do their best to minimize their taxable income (and some risk takers try to hide it altogether) doesn’t help, either.

Still Want to Start a Home Business?

If the downside of a home business hasn’t deterred you, we have lots more information to get and keep your home business up and running, including:

- Best Bet Home Businesses

- Home Business Planning

- 22 Home Office Ideas

- Home Business Financing

- Legal Information

- Home Business Marketing

- Home Business Stories

- The Facts About Home Business